FIG PUBLICATION NO. 67

Property Taxation for Developing Economies

FIG Commission 9 – Valuation and the Management of Real Estate

FIG REPORT

Authors: Frances Plimmer and William J McCluskey

FOREWORD

The International Federation of Surveyors (FIG), and Commission 9 (The

Valuation and Management of Real Estate) are proud to present Property

Taxation for Developing Economies, by Frances Plimmer and William J

McCluskey. This work promotes the careful consideration of a transparent,

fair, fast and relatively cost efficient real estate taxation system that

could be applied successfully in some developing and transitional economies.

Many advanced economies rely upon a complex ad valorem property tax regime

that inherently requires relatively high cost and expertise levels. The

authors propose the consideration of a less costly and more easily

established banding system and discuss how and why this system may be

introduced into jurisdictions which lack the necessary resources to

implement a more complex discrete ad valorem assessment system.

This publication touches upon the various types of taxation common among

national economies and narrows its focus specifically upon recurrent

property taxes. The authors examine the primary social need for a recurrent

property tax, various taxation systems, the data, resources and skills

necessary for its implementation as well as ongoing maintenance and social

acceptance factors, as a setting for any successful tax regime and economy.

Within Great Britain and Ireland, a very cost and time efficient system was

needed to overcome some of the barriers in creating a complex discrete ad

valorem recurrent property tax system. From this need, a banding system, was

born. A property value banding system allocates properties into different

categories (or Bands) according to an estimate of some value based criteria

as a basis for the property tax bill. Instead of valuing properties to a

discrete point, the property values are estimated according to a range of

values (Bands). Based on the level of available data, resources, economic,

social and political realities, banding should be considered as a possible

and proven system for producing a speedy, transparent, fair, cheap and

robust tax base.

This work considers the benefits of its wider application across nations in

a theoretical discussion as well as examining case studies showing how this

system has fared in jurisdictions where it is currently being applied. These

case studies expand upon the theoretical discussion by allowing real world

experience, to highlight the strengths and weaknesses of its application in

other countries.

The primary focus of this publication is the application of the banding

system, and this is considered in comparison with discrete ad valorem

taxation systems with greatest emphasis on residential properties.

Residential properties make up the bulk of the real estate tax base in most

regions and a greater flexibility in banding or emphasis on discrete

valuation is likely more appropriate for commercial and unusual property

types. The relative benefits of the banding system should be carefully

considered as either a long term or interim solution in an emerging

economy’s development toward sustainable property taxation. The work herein

gives a clear picture of these two systems, and provides an excellent

resource for decision makers to consider how they may apply in other

countries. This work significantly enhances the current body of work on

recurrent property taxation and is a valuable tool for decision makers at

all levels.

| Steven Nystrom |

Chryssy Potsiou |

| MAI – FIG Chairman of Commission 9 (2015) |

FIG President |

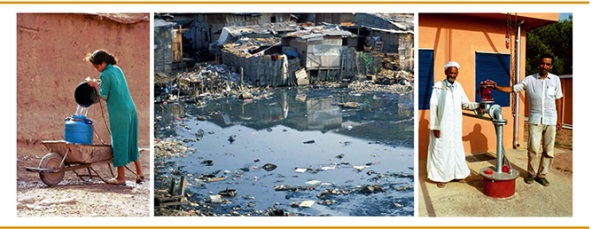

The main objective of the Global Land Tools Network is to contribute to

poverty alleviation and the Sustainable Development Goals (SDGs) through

land reform, improved land management and security of tenure.

This publication discusses a practical and resource-led approach to

implementing an efficient and effective system of taxing real estate in order to

raise funds to pay for much needed community services for the benefit of local

inhabitants.

The focus is on developing a system based on available resources, rather than

a “wish list”, and recommends that the tax be paid by property occupiers (rather

than owners) in the absence of a comprehensive land title register.

Such a system can be both sustainable and scalable, and, with good governance

together with the delivery of appropriate services, can enhance the quality of

life and opportunities for improvement for communities.

The support of the GLTN for this FIG publication demonstrates the continued

commitment of both organisations to their common goal of delivering beneficial

land administration systems for the improved financial, physical and social

environments of the world’s disadvantaged citizens.

Oumar Sylla

Unit Leader, Land and Global Land Tool Network

Urban Legislation, Land and Governance Branch, UN-Habitat

EXECUTIVE SUMMARY

The purpose of this publication is to promote discussion on a relatively simple,

sustainable, speedy and cost-effective system of property taxation which can be

introduced in jurisdictions with a paucity of the resources normally required to

administer a more complex ad valorem property tax regime. This discussion takes

place within the context of existing examples of Banded tax assessments and is

based on the needs and the limited resources of the so-called developing and

transitional economies.

Community growth, in terms of environmental, economic and social development,

is inextricably linked to the provision of public services which facilitate and

enable groups and individuals to improve their circumstances. However, local

government can generally only afford the provision of such services provided the

community contributes in the form of local taxation, generally a levy based on

the value (or some surrogate) of the real estate owned and occupied by

individuals, companies and other groups.

There is a wide range of different forms of local taxation applied throughout

the world, but most rely to a greater or lesser extent on complex economic,

technical and human resources. Similarly, to tax property owners, a

comprehensive and up-to-date database of registered land owners is required. But

how can local governments respond to the needs of their communities for public

services when such resources are absent?

This report demonstrates the development of a property tax system built

around available resources, rather than a “wish list”. Two case studies

illustrate the successful introduction of the Banding of tax assessments, in

contexts where speed and low cost of introduction were critical, and where

tax was imposed on residential occupiers (in the absence of a complete and

up-to-date register of owners).

Banding works on the principle of grouping together dwellings into

various value (or some surrogate) bands and applying a rate of tax to each

band. In this way, there is need for only minimal valuation skills and the

process of banding can be achieved swiftly and cheaply. Provided the

taxpayers can be satisfied with the extent to which horizontal and vertical

equity are sacrificed (i.e. those in similar situations pay similar amounts

of tax, and those in different situations pay different amounts of tax, as

reflected in the bands), then a high degree of social acceptability for the

system is likely. This can be improved by involving communities themselves

in the process of introducing the tax as well as by extensive education of

communities as to the characteristics of and reasons for such a tax system.

By adapting the principles discussed in this report, jurisdictions can

use their available resources to develop a tax system which produces a

reliable revenue stream for the provision of much needed local public

services in a speedy manner.

INTRODUCTION

The purpose of this paper is to promote discussion on a relatively simple,

sustainable, speedy and cost-effective system of property taxation which can be

introduced in jurisdictions with a paucity of the resources normally required to

administer a more complex ad valorem property tax regime. This discussion takes

place within the context of existing examples of banded tax assessments and is

based on the needs and the limited resources of the so-called developing and

transitional economies.

Property taxes, or more specifically, taxes on real estate, are imposed

in almost every country in the world as part of a balanced system of

taxation (IAAO, 2010). Such taxes can be broadly classified in two ways:

(a) ‘General’ taxes, such as an income tax, capital gains tax, transfer

tax, death / inheritance taxes, and sales tax, are imposed on a range of

real estate assets or transaction events. These include the receipt of

income from investments, or capital receipts on the disposals of a range of

assets, including real estate. In general terms, real estate is treated no

differently from any other asset class. These are not what we classify as

‘property taxes’, and this paper is not concerned with such ‘general’ taxes;

(b) ‘Recurrent’ taxes on the value of, or some surrogate figure applied

to, units of real estate, which may comprise ‘land’, ‘land and buildings’ or

‘buildings’. Other assets may be included within these definitions but only

because of their (physical) attachment to the land etc. and because of the

nature of the definition of taxable property, imposed by the individual

nation’s legislation. Thus, for example, where the tax is imposed on ‘land

and buildings’ or ‘buildings’ alone, the taxable real estate may include

plant and machinery, pipes installed in the building for the supply and

disposal of water, electrical services and other ‘chattels’ which have

become an integral part of the building.

This paper is solely concerned with such recurrent taxes which are

imposed in almost all countries across the world, and which in this paper

are called ‘property tax’ (Bird and Slack, 2004; McCluskey, 1999).

All taxes are a creation of national legislation, (they do not exist in

common law), and the specific details of the property tax imposed in any

jurisdiction are contained in the relevant body of legislation. In many

countries, the body of law which relates to such taxes includes government

regulations issued in accordance with existing legislation and judicial

interpretations of legislation.

The tax payable is a factor of the level of tax imposed (or the rate of

tax) and the assessed value (or some surrogate of the value) of the property

to be taxed. The calculation of tax payable is, therefore, a simple

calculation of rate of tax multiplied by the assessed value. For example: a

10 cents in the dollar rate of tax and an assessed value of $5,000 produces

a tax bill of ($0.10 * $5,000) $500.

The tax rate is determined in accordance with national legislation,

normally by either national or local governments or a combination of the

two; where, for example, national government fixes the rate of tax and

individual municipalities may have the power to vary this rate by a given

percentage (often within a narrow range).

The assessed value of taxable property is normally either:

- based on the value of the property (an ad valorem tax base); or

- a non-value assessment, which may be the product of a formula

based on such ‘value influence’ factors such as age, use, location, and

(net or gross) usable area.

There is, however, a huge variation in the nature and structure of

property assessments across the world, and for further information, readers

are advised to consult more detailed texts on the subject, such as McCluskey

et al., (2013) and Slack and Bird, (2015). In some countries (for example,

China, Botswana, Lesotho), such taxes are imposed within urban areas only.

In some cases, (e.g. Australia, the United Kingdom and the United States),

different states, jurisdictions or cities within the country operate

different forms of property tax systems. Indeed, the huge variation of

property taxes imposed in countries around the world makes any

generalisation of specifics extremely hard. Thus, it is clear that, in terms

of property taxation, no one size fits all.

A property tax system which works well in one jurisdiction may not be

transposable to another with equally successful results. Differences in

socio-political aspirations, perceptions of and traditions relating to land

rights, infrastructures, available resources, history, needs and cultures

all have an effect on the type of property tax which will or will not work

for the stakeholders involved (UN-HABITAT 2011b).

Regardless of national etc. variations, the principle which seems to

underpin such taxes is that their revenue (generally supplemented by

additional central government funds) supports local services which benefit

both individuals, their real estate and their wider community, in terms of

improving the quality of life of residents and increasing the value of real

estate. It is also recognised (UN-HABITAT, 2011a) that taxation can be a

tool to manage land use and urban development, as well as a means to recoup

increases in land values which result from the range of taxation and other

government policies.

National legislation is likely to be responsible for identifying the

nature and range of services which are to be provided by local authorities.

Where there is flexibility within 8 the system for the municipalities to

vary the level of tax raised, there may also be the opportunity for

discretion as to the nature and quality of services provided. In this way,

such a system is able to respond to calls for increased or varied service

provision, recognising a degree of local democratic accountability between

the local taxpayers and the local authorities.

The Voluntary Guidelines on the Responsible Governance of Tenure of Land,

Fisheries and Forests in the Context of National Food Security (FAO, 2012)

recognise the importance of property taxes as sources of funding for local

services:

States should strive to develop policies, laws and organisational

frameworks for regulating all aspects pertaining to taxation of tenure

rights. Tax policies and laws should be used where appropriate to provide

for effective financing for decentralized levels of government and local

provision of services and infrastructure. (ibid. para. 19.2)

The rights which are fundamental to property ownership and occupation

have significant ‘value’ attached to them and this ‘value’ is directly

linked to the benefits which owners and occupiers received from the quality

of their immediate and wider locational environment. Such an environment is

maintained and improved by the services provided by the municipality which

is the recipient of the yield of the property tax thus creating a clear and

perceptible link in the minds of taxpayers as to the benefits which tax paid

bring. (Plimmer and McCluskey, 2012a; 2012b). A property tax which reflects

the up-to-date ad valorem ‘value’ of real estate and which is charged on an

annual basis is therefore considered to be an integral part of a balanced

national taxation regime (IAAO, 2010).

It is generally recognised (IAAO, 2010) that an up-to-date ad valorem tax

base provides the ‘best’ system of spreading the tax burden across taxpayers

based on their relative wealth in terms of their real estate holdings, and

thus maximising ‘fairness’ between taxpayers. Such a tax base should be

subject to annual revaluations so that the share of the tax liability

between taxpayers is continually adjusted to reflect the relative movement

of property prices in the market.

In countries where there is a mature property tax, which is levied on the

market value of real estate, where collection rates are high (e.g. above

95%), where there is a culture of tax payments, and where society is

provided with useful, well organised and beneficial public services, there

is of necessity a large, efficient and effective resource base to support

the tax regime of assessment, billing, enforcement, payment–as well as

service provision (Bahl and Wallace, 2008; Bahl et al., 2010).

Thus, the opportunity to produce such ad valorem assessments is generally

limited to those countries with certain very specific resources, which

include:

- an active, thriving and mature property market in which all types

of taxable real estate are traded and from which a suitable amount of

accurate and reliable transactional data is available for comparison

purposes;

- a database of property owners on whom the tax can be

imposed, generally based on or linked to a register of land title or

cadastre of land ownership;

- a system of municipalities with the staffing and

technological resources to both administer the demand for, collection

and enforcement of a tax liability, and to provide the necessary public

services efficiently and effectively;

- a separate body of professional valuers or assessors, skilled and

experienced in the full range of valuation methodologies and in the

valuation of all types of taxable properties, from all locations within

the jurisdiction in which the tax is imposed;

- a population which recognises the benefits of the services paid

for by their taxes and which is therefore willing to pay, as well as to

engage with their municipality in genuine debate as to the nature and

quality of the services provided, and

- a government which is responsive to changing circumstances and

which ensures that the legislation under which the property tax is

imposed is up-to-date, comprehensive, coherent, and appropriate for the

needs of all stakeholders.

In order to obtain such data, personnel and technological resources are

required to gather and analyse relevant information and, in the case of the

assessment, a high level of professional expertise is necessary. Similarly,

complex technology to support its administration is also important for

effective and efficient management of the process. All this, of course,

costs money, not merely in terms of capital expenditure, but also in terms

of on-going maintenance (as well as the costs of the education of human

resources). For financial and other reasons, many governments are unable to

develop and maintain such a system for the raising of property-based

taxation. In such cases, where no or limited funding is available for public

services, the demand for the full range and quality of public services from

communities continues unsatisfied, with the potential for social resentment

and unrest.

Where the necessary resources to produce an ad valorem tax base are

lacking, some surrogate non-value-based assessment must be relied upon, or,

as in the case of Great Britain in the early 1990s and the Republic of

Ireland more recently, where cost and speed were major considerations (refer

the Appendices).

We therefore hypothesise that where a paucity of necessary resources is

the major barrier to the introduction of a property tax system, or such a

barrier prevents the improvement of a limited or unsatisfactory tax regime,

a simple system based on the banding of properties which reflects the

available data and resources could provide an opportunity to achieve revenue

from land ‘value’ and thus income for municipalities to improve the

economic, social and physical environment of their citizens.

This publication discusses some of the basic criteria which are normally

considered to be important in a real property tax; the issue of necessary

resources is then discussed. The focus of this paper on a system of

‘banding’ taxable units is explained together with an analytical reflection

as to how this system might be introduced into jurisdictions which lack

necessary resources to implement a more complex system of discrete ad

valorem assessments. Finally, two case study examples of banding in practice

are presented in the Appendices. These discuss how and why banding has been

introduced and implemented within two jurisdictions, together with the

perceived benefits and disadvantages. The experiences from these case

studies are referred to, as necessary, in the earlier parts of this

publication.

Authors: Authors: Frances Plimmer and William J McCluskey

Read the full FIG Publication 67 in pdf

Copyright © The International Federation of Surveyors (FIG),

March 2016.

All images are the copyright of the World Bank and used

under their terms and conditions.

All rights reserved.

International Federation of Surveyors (FIG)

Kalvebod Brygge 31–33

DK-1780 Copenhagen V

DENMARK

Tel. + 45 38 86 10 81

E-mail: FIG@FIG.net

www.fig.net

Published in English

Copenhagen, Denmark

ISSN 1018-6530 (printed)

ISSN 2311-8423 (pdf)

ISBN 978-87-92853-43-1 (printed)

ISBN 978-87-92853-44-8 (pdf)

Published by

International Federation of Surveyors (FIG)

Printer: 2016 LaserTryk.dk A/S, Copenhagen, Denmark

|